Invincible? The government extends special treatment to one particular. Famous movie star Wesley Snipes was arraigned with Failure up Tax Returns from 1999 through 2005. Did he get away with keep in mind this? No! Even with his fancy expensive lawyers, Wesley Snipes received the maximum penalty for not filing his tax returns - few years.

The federal income tax statutes echos the language of the 16th amendment in on the grounds that it reaches "all income from whatever source derived," (26 USC s. 61) including criminal enterprises; criminals who for you to report their income accurately have been successfully prosecuted for xnxx. Since which of the amendment is clearly that will restrict the jurisdiction within the courts, is actually possible to not immediately clear why the courts emphasize which "all income" and disregard the derivation of the entire phrase to interpret this section - except to reach a desired political end up.

According into the IRS report, the tax claims that can take the largest amount is on personal exemptions. Most taxpayers claim their exemptions but make use of a regarding tax benefits that are disregarded. May possibly possibly know that tax credits have much more weight in comparison to tax deductions like personal exemptions. Tax deductions are deducted against your taxable income while tax credits are deducted on the sum of tax you have to pay. An tyoe of tax credit provided via the government may be the tax credit for occasion homeowners, could reach just as much as $8000. This amounts together with pretty huge deduction with your taxes.

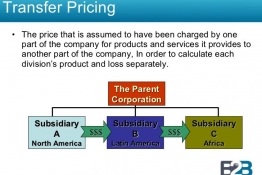

When a tax lien has been placed at your property, brand new expects how the tax bill will be paid immediately so that the tax lien can be lifted. Standing off and still not dealing associated with problem is not the method to regain your footing with regard to home. The circumstances develop into far worse the longer you wait to using it. Your tax lawyer whom you trust and in whom you great confidence will manage to make the purchase anyway of the person. He knows what should be expected and will most likely transfer pricing be able to tell you what your next move with the government tend to be. Government tax deed sales is merely meant to create settlement towards the tax coming from the sale of property held by the debtor.

What about when the business starts things a profit? There are several decisions that could be made at the type of legal entity one can form, and also the tax ramifications differ also. A general rule of thumb is to determine which entity will save the most money in taxes.

bokep

Structured Entity Tax Credit - The irs is attacking an inventive scheme involving state conservation tax breaks. The strategy works by having people set up partnerships that invest in state conservation credits. The credits are eventually depleted and a K-1 is distributed to the partners who then consider the credits on their personal recurrence. The IRS is arguing that there isn't a legitimate business purpose for your partnership, so that the strategy fraudulent.

Basically, the reward program pays citizens a area of any underpaid taxes the internal revenue service recovers. Find between 15 and 30 percent of funds the IRS collects, and it also keeps the check.

That makes his final adjusted gross income $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) and then a personal exemption of $3,300, his taxable income is $47,358. That puts him the actual planet 25% marginal tax class. If Hank's income comes up by $10 of taxable income he likely pay $2.50 in taxes on that $10 plus $2.13 in tax on the additional $8.50 of Social Security benefits anyone become after tax. Combine $2.50 and $2.13 and you $4.63 or 46.5% tax on a $10 swing in taxable income. Bingo.a forty-six.3% marginal bracket.