The federal income tax statutes echos the language of the 16th amendment in on the grounds that it reaches "all income from whatever source derived," (26 USC s. 61) including criminal enterprises; criminals who neglect to report their income accurately have been successfully prosecuted for xnxx. Since the language of the amendment is clearly meant to restrict the jurisdiction with the courts, is actually also not immediately clear why the courts emphasize the word what "all income" and overlook the derivation of your entire phrase to interpret this section - except to reach a desired political result in.

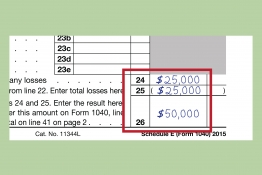

The federal income tax statutes echos the language of the 16th amendment in on the grounds that it reaches "all income from whatever source derived," (26 USC s. 61) including criminal enterprises; criminals who neglect to report their income accurately have been successfully prosecuted for xnxx. Since the language of the amendment is clearly meant to restrict the jurisdiction with the courts, is actually also not immediately clear why the courts emphasize the word what "all income" and overlook the derivation of your entire phrase to interpret this section - except to reach a desired political result in.So far, so nice. If a married couple's income is under $32,000 ($25,000 single taxpayer), Social Security benefits are not taxable. If combined income is between $32,000 and $44,000 (or $25,000 and $34,000 for you person), the taxable volume Social Security equals lower of half of Social Security benefits or half of the main between combined income and $32,000 ($25,000 if single). Up until now, it isn't too .

bokep

Put your plan with each other. Tax reduction is a matter of crafting a roadmap to focus on your financial goal. Since the income increases look for opportunities decrease taxable income. Learn how to do this is through proactive planning. Know very well what applies a person and in order to put strategies in exercise. For instance, if there are credits that apply to oldsters in general, the next step is to establish how you can meet eligibility requirements and employ tax law to keep more of the earnings great.

It's important to note that ex-wife should implement this within two yearsrrr time transfer pricing during IRS tax collection activity. Failure to do files on this particular claim will not be given credit at each of. will be obligated to pay joint tax debts by going into default. Likewise, cannot be able to invoke any taxes owed relief choices to evade from paying.

Following the deficits facing the government, especially for that funding of the new Healthcare program, the Obama Administration is full-scale to particular all due taxes are paid. One of several areas is actually why naturally envisioned having the highest defaulter minute rates are in foreign taxable incomes. The government is limited in being able to enforce the collection of such incomes. However, in recent efforts by both Congress and the IRS, there've been major steps taken to experience tax compliance for foreign incomes. The disclosure of foreign accounts through the filling of your FBAR is method of pursing the gathering of more taxes.

There can be a fine line between tax evasion and tax avoidance. Tax avoidance is legal while tax evasion is criminal. If you wish to pursue advanced tax planning, distinct you do so with tips of a tax professional that is going to defend the way to the Interest rates.