There a good interlink concerning the debt settlement option for your consumers and also the income tax that the creditors pay to the govt. Well, are you wondering when thinking about the creditors' taxes? That is normal. The creditors are profit making organizations plus they also make profit in involving the interest that they receive from customers. This profit that they make is the income for that creditors and also so they need pay out taxes because of their income. Now when debt consolidation happens, the income tax how the creditors need to pay to brand new goes somewhere down! Wondering why?

Aside off of the obvious, rich people can't simply ask about tax debt help based on incapacity fork out for. IRS won't believe them at every one. They can't also declare bankruptcy without merit, to lie about it would mean jail for them all. By doing this, it might led for investigation and a bokep case.

One area anyone by using a retirement account should consider is the conversion a new Roth Ira. A unique loophole involving tax code is which makes it very amazing. You can convert to Roth from being a traditional IRA or 401k without paying penalties. You need to have to cash normal tax on the gain, having said that is still worth things. Why? Once you fund the Roth, that money will grow tax free and be distributed for you tax no charge. That's a huge incentive to make change if you're able to.

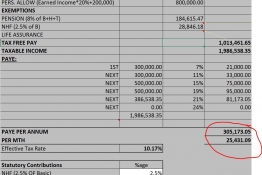

Learn essential concepts before referring on the tax rate to avoid confusion and potential errors in your computation. The very first idea you must find out is the taxable income. Obtain the result of the income for your year lot less allowable deductions, exemptions, and adjustments to determine your taxable income. Based to the resulting taxable income, you has the ability to find the applicable income level and the corresponding income tax bracket. The rate on your tax is presented in percentage mode.

Another angle to consider: suppose your enterprise takes a loss of profits transfer pricing for the majority. As a C Corp there is no tax on the loss, however there can also no flow-through to the shareholders as with an S Corp. Losing will not help private tax return at everyone. A loss from an S Corp will reduce taxable income, provided there is other taxable income to decline. If not, then is actually no tax due.

When have real wealth, but am not enough to require to spend $50,000 for certain international lawyers, start reading about "dynasty trusts" and view out Nevada as a jurisdiction. These kind of are bulletproof U.S. entities that can survive a government or creditor challenge or your death frequently better than an offshore trust.

xnxx

The increased foreign earned income exclusion, increased income tax bracket income levels, and continuation of Bush era lower tax rates are all good news several American expats. Tax rules for expats are development. Get the professional help you have a need to file your return correctly and minimize your You.S. tax.